The IFS as ever has amazing statistics.

1. the tax landscape (https://ifs.org.uk/taxlab/taxlab-key-questions/where-does-government-get-its-money?tab=tab-312)

Two-thirds of tax revenue comes from just three taxes: income tax, (28%) National Insurance contributions (NICs) (18%) and value added tax (VAT) (18%). Company tax = 11%. excise taxes 9%. (that's 84%).

2. Corporation tax https://ifs.org.uk/taxlab/taxlab-taxes-explained/corporation-tax-explained

"In 2018–19, 55% of all corporation tax was paid by companies that made a tax payment of £1 million or more: a group of fewer than 5,000 companies, making up just 0.3% of the population of corporation-tax-paying businesses."

3. income tax (https://ifs.org.uk/taxlab/taxlab-key-questions/where-does-government-get-its-money?tab=tab-312)

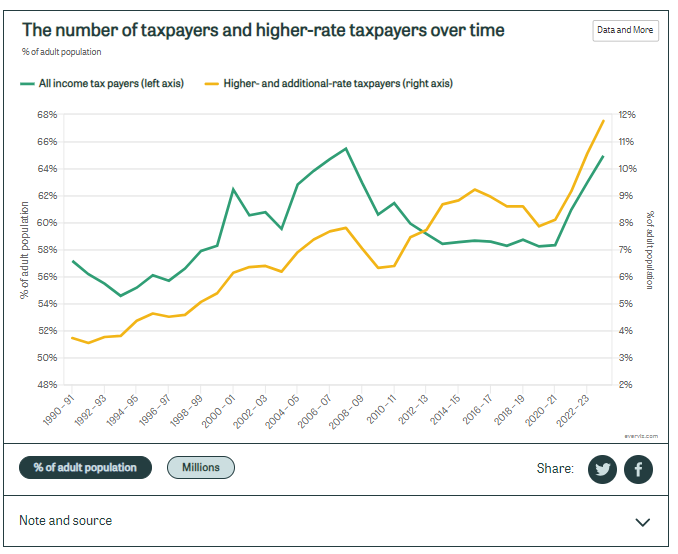

Higher rate taxpayers are 10% of the adult population: 6.5m people

what about the skew?

"In 2023–24 the top 1% of taxpayers (that is, those with incomes exceeding £214,000) received 13% of taxpayers’ pre-tax income and provided 29% of all income tax revenue."

" The top 10% of taxpayers paid 60% of all income tax in 2023–24, up from 35% in 1978–79. The share of income tax revenue contributed by the top 1% of taxpayers rose from 11% in 1978–79 to 29% in 2023–24, despite big cuts in top rates of tax in the first 10 years of that period.