A nerdy blog.

1. many goods have lots of variation in prices e.g. with sales

2. suppose, says Eriwn Diewert in Scanner Data, Elementary Price Indexes and the Chain Drift Problem

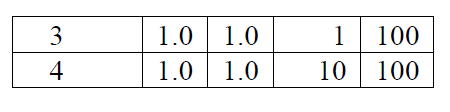

Revised October 13, 2021 we have the following data where good 2 is never on sale, but good 1 is and gets a massively changing set of quanties, rising in the time, then returning, but importantly, not instantly, to initial quantities

4. the table below shows "Table 2 lists the fixed base Fisher, Laspeyres and Paasche price indexes, PF(FB), PL(FB) and PP(FB) and as expected, they behave perfectly in period 4, returning to the period 1 level of 1. Then the chained Fisher, Törnqvist-Theil, Laspeyres and Paasche price indexes, PF(CH), PT(CH), PL(CH) and PP(CH) are listed. Obviously, the chained Laspeyres and Paasche indexes have chain drift bias that is extraordinary but what is interesting is that the chained Fisher has a 2% downward bias and the chained Törnqvist has a close to 3% downward bias."