We need a more skilled economy to get more economic growth says everyone. Some maths to help this out. According to this nice website, average years of education are as below

With the data being for the UK 0.92 years in 1870, 6.24 years in 1940, 7.01 years in 1960, 9.97 years in 2000 and 12.46 years in 2010. Since 1960 that's a rise of 0.109 years per year. If the return to education is 7% and the share of labour in value added is 0.66, that's a contribution to GDP growth of 0.005, that is, 0.5pppa. GDP growth was, 1960-2010, 2.6%.

An occasional blog on economics. Designed for students and those interested in Economics topics.

Tuesday, 20 February 2018

Tuesday, 13 February 2018

The ONS Productivity Release, February 2018

...Contains many important findings. here are just two

In turn.

1. Industries and industry mix.

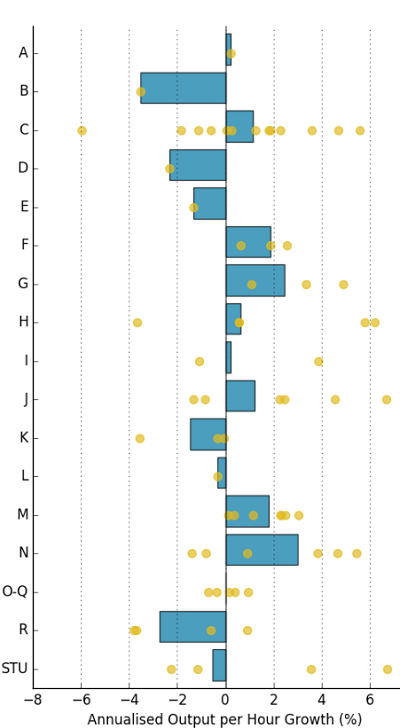

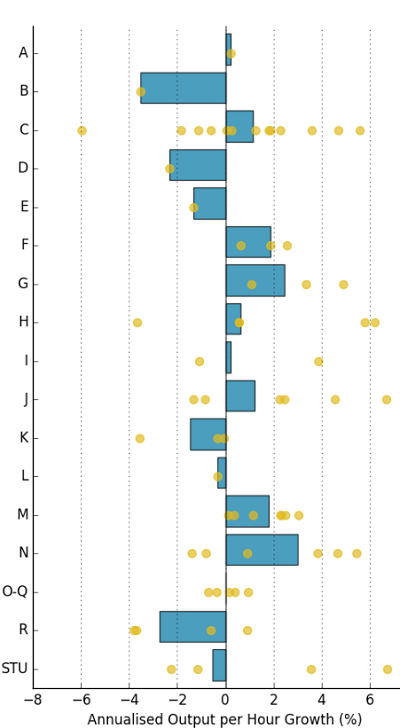

There's a lot of within industry heterogeneity

A: Agriculture, forestry and fishing; B: Mining and quarrying; C: Manufacturing; D: Electricity, gas, steam and air conditioning supply; E: Water supply, sewerage, waste management and remediation activities; F: Construction; G: Wholesale and retail trade; repair of motor vehicles and motorcycles; H: Transportation and storage; I: Accommodation and food service activities; J: Information and communication; K: Financial and insurance activities; L: Real estate activities; M: Professional, scientific and technical activities; N: Administrative and support service activities; O-Q: Public administration, defence, education, human health and social work activities; R: Arts, entertainment and recreation; and STU: Other service activities; activities of household and extra-territorial organisations and bodies.

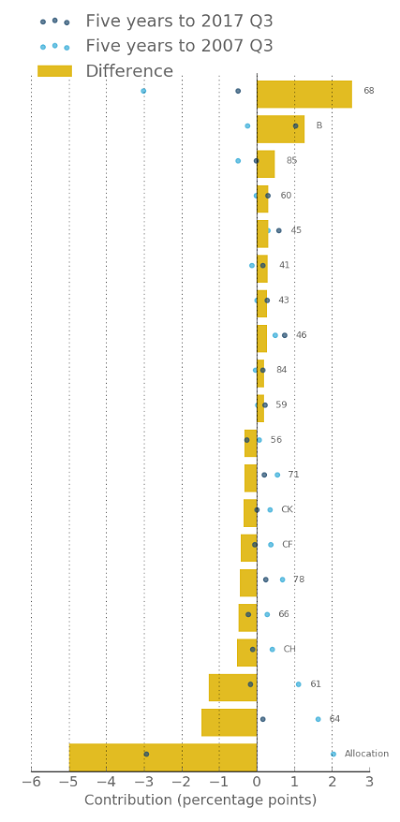

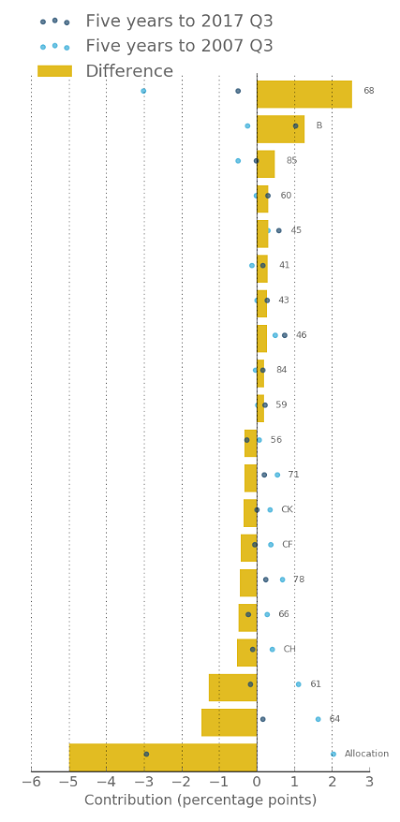

Which industry is the largest contributor? This is interesting:

Notes: 68: Real estate activities; B: Mining and quarrying; 85: Education; 60: Programming and broadcasting activities; 45: Wholesale and retail trade and repair of motor vehicles and motorcycles; 41: Construction of buildings; 43: Specialised construction activities; 46: Wholesale trade, except of motor vehicles and motorcycles; 84: Public administration and defence; compulsory social security; 59: Motion picture, video and television programme production, sound recording and music publishing activities; 56: Food and beverage service activities; 71: Architectural and engineering activities; technical testing and analysis; CK: Manufacture of machinery and equipment n.e.c.; CF: Manufacture of basic pharmaceutical products and pharmaceutical preparations; 78: Employment activities; 66: Activities auxiliary to financial services and insurance activities; CH: Manufacture of basic metals and metal products; 61: Telecommunications; and 64: Financial service activities, except insurance and pension funding.

So it turns out that reallocation is the biggest contributor.

The allocation formula is hard to find, it is in this information note (thanks to ONS for providing this).

And says that the reallocation effect is the sum of (a) the movement of labour to above- or below-average industries and (b) the covariance between productivity growth and labour share growth. Notice that the allocation effect was positive before the great recession and negative afterwards.

more details on this are found here. My reading is that there has been a collapse in the labour effect, that is, much of the reallocation problem seems to be a a fall in the extent to which labour is flowing to high productivity industries.

This below diagram is figure 9 from https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/labourproductivity/articles/divisionlevellabourproductivityestimates/january2018#the-effect-of-reallocation-on-output-per-hour-growth.

1. New estimates of labour productivity suggest that changes in the aggregate mix of activity in the UK economy – as well as lower productivity growth in telecommunications, manufacturing and finance industries – account for a large proportion of the UK’s recent productivity slowdown.

2. Experimental estimates indicate that current price investment in intangible assets was £134.2 billion in 2015, compared with £141.7 billion for investment in tangible assets over the same period; this is the first time since 2000 that investment in tangible assets has been higher than investment in intangible assets

In turn.

1. Industries and industry mix.

in this release we have extended the time series of our detailed-industry labour productivity dataset back to 1997. These data include labour productivity data for 66 different industry groupings and for around 50 “division” level industries from the Standard Industrial Classification 2007: SIC 2007

There's a lot of within industry heterogeneity

Figure 1 shows the annualised compound average growth rates of labour productivity between Quarter 1 (Jan to Mar) 2009 and Quarter 1 2017, for both industry sections (an aggregated industry breakdown – the bars), and the lower, division-level components of those industries (the points)

A: Agriculture, forestry and fishing; B: Mining and quarrying; C: Manufacturing; D: Electricity, gas, steam and air conditioning supply; E: Water supply, sewerage, waste management and remediation activities; F: Construction; G: Wholesale and retail trade; repair of motor vehicles and motorcycles; H: Transportation and storage; I: Accommodation and food service activities; J: Information and communication; K: Financial and insurance activities; L: Real estate activities; M: Professional, scientific and technical activities; N: Administrative and support service activities; O-Q: Public administration, defence, education, human health and social work activities; R: Arts, entertainment and recreation; and STU: Other service activities; activities of household and extra-territorial organisations and bodies.

Which industry is the largest contributor? This is interesting:

growth in whole economy labour productivity can be decomposed into contributions from each industry – reflecting the effect that productivity growth within an industry has on the UK’s aggregate performance – as well as an allocation effect. This allocation effect captures changes in the mix of different industries in the UK economy overall, in terms of both shares in value added and shares of labour input. For instance, if the share of labour input used by a low-productivity (high-productivity) industry increases through time at the expense of high-productivity (low-productivity) industries, then the UK’s aggregate performance will weaken (strengthen), independent of the growth rates of productivity within specific industries. In other words, productivity in each individual industry could increase, but overall productivity could still fall if sufficient labour moved from higher to lower productivity industries.

By comparing the contributions to labour productivity growth of specific industries prior to the downturn with the equivalent contributions to growth following the downturn, the change in contributions can be used to help explain the slowdown of whole economy productivity growth. This is shown in Figure 2, which uses the new, longer time series of labour productivity to compare contributions to growth in the five years to Quarter 3 (July to Sept) 2007 (the light points) with contributions to growth in the five years to Quarter 3 2017 (the dark points). The differences between these points are shown as bars and these represent the change in the contribution of each industry to aggregate labour productivity growth over this period. Industries are ordered from those whose contribution increased the most, to those whose contribution was most reduced. The same is also done for the allocation effect. To highlight the important results, only the top 10 and bottom 10 contributors are shown

Notes: 68: Real estate activities; B: Mining and quarrying; 85: Education; 60: Programming and broadcasting activities; 45: Wholesale and retail trade and repair of motor vehicles and motorcycles; 41: Construction of buildings; 43: Specialised construction activities; 46: Wholesale trade, except of motor vehicles and motorcycles; 84: Public administration and defence; compulsory social security; 59: Motion picture, video and television programme production, sound recording and music publishing activities; 56: Food and beverage service activities; 71: Architectural and engineering activities; technical testing and analysis; CK: Manufacture of machinery and equipment n.e.c.; CF: Manufacture of basic pharmaceutical products and pharmaceutical preparations; 78: Employment activities; 66: Activities auxiliary to financial services and insurance activities; CH: Manufacture of basic metals and metal products; 61: Telecommunications; and 64: Financial service activities, except insurance and pension funding.

So it turns out that reallocation is the biggest contributor.

Firstly, at this level of detail1, the allocation effect accounts for 5 percentage points of the 7.1 percentage points slowdown in productivity between the two periods. This means that changes in the mix of industries in which individuals are employed accounts for the largest proportion of the slowdown in growth in recent years. Rather than adding to labour productivity growth as it did over the five years to Quarter 3 2007, the allocation effect held back output per hour growth over this period.

Secondly, the slowdown in measured productivity growth in several industries plays an important role in explaining the slowdown in the UK’s aggregate performance in recent years. In particular, the telecommunications2, finance, and manufacturing industries made considerable contributions over this period.

The allocation formula is hard to find, it is in this information note (thanks to ONS for providing this).

And says that the reallocation effect is the sum of (a) the movement of labour to above- or below-average industries and (b) the covariance between productivity growth and labour share growth. Notice that the allocation effect was positive before the great recession and negative afterwards.

more details on this are found here. My reading is that there has been a collapse in the labour effect, that is, much of the reallocation problem seems to be a a fall in the extent to which labour is flowing to high productivity industries.

This below diagram is figure 9 from https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/labourproductivity/articles/divisionlevellabourproductivityestimates/january2018#the-effect-of-reallocation-on-output-per-hour-growth.

Subscribe to:

Comments (Atom)